Impact investing has evolved from its early days when it was largely driven by the simple desire to "do good." Today, diligent impact investors and impact LPs demand a more sophisticated approach, emphasizing not only the intent to create positive change but also requiring a rigorous measurement and verification of the intended positive outcomes.

This shift towards a more formal and structured evaluation of impact is stressed by a greater demand for transparency and the use of concrete data to support claims of impact. However, simply disclosing numbers or metrics is insufficient without justifying and explaining why such metrics are a good proxy to measure impact.

The challenge then, is how to cohesively explain so in a logical, simple, and standardized manner. Enter, the Theory of Change (ToC). In this post, we'll share more about the Theory of Change, what is it, how it solves the previous issue, why it matters for investors to integrate it to their investment screening processes, and how NorthStar's impact assessment AI can help.

Theory of Change: The Cornerstone of Explainable Impact Investing

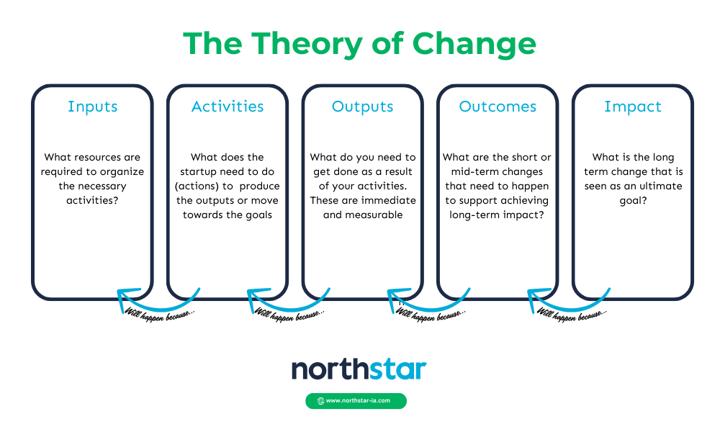

The ToC is crucial in all fronts of impact ventures. In short, the ToC is a canvas that serves as a simple, yet comprehensive framework to explain how and why a desired change is expected to happen within a specific context.

The ToC framework maps the pathway from inputs (the resources invested) to activities, and from the resulting outcomes of these activities to the ultimate impact goals. By clearly identifying the impact desired and outlining the steps needed to achieve them, the ToC helps fouders and startups align their strategies with their overall vision of a better world.

The real value of a ToC lies in its ability to not only describe what an organization plans to do but also to explain why the selected strategies and actions are expected to lead to the intended impact. This transparency about the underlying assumptions is essential for both internal clarity and external communication.

A shared common language.

A founding team who is intentional and truly has impact at the core, is capable of explaining the ultimate benefit they expect to create and how to achieve it. For the impact-savvy, the theory of change becomes the common thread -or language- used to explain and outline how activities and inputs will connect to that expected result.

By using a common language, the impact case is easier to understand and facilitates others -particularly investors- to rally behind their cause.

Creating a Simple and Effective ToC

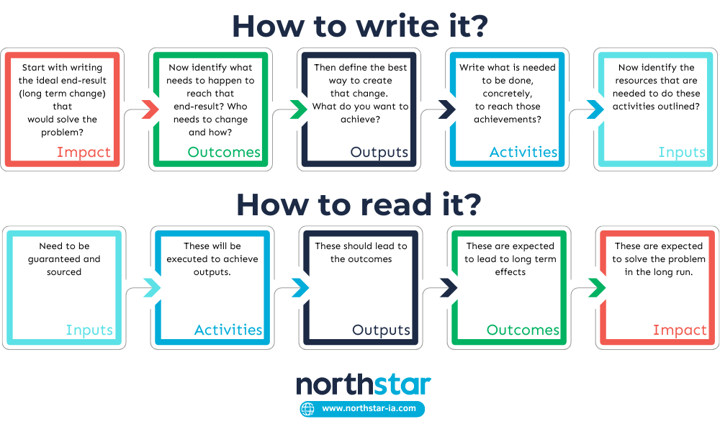

Writing a compelling ToC involves a clear articulation of the initial conditions, the intended changes, and the mechanisms through which these changes will occur. This apparently simple activity typically requires multiple iterations, critical thinking, and someone with a critical mind who can provide transparent & constructive feedback. The most successful impact implementations have in common a constant search for distilling the ideas to the most basic elements, limiting the content of the ToC to the truly critical inputs. Put in other words, a long, complex ToC is no better than a short, precise and clear ToC.

The process starts by defining the long-term goals and then working backwards to identify the necessary outcomes that need to be realized to reach these goals. Each outcome is broken down into outputs (the tangible results of specific activities) and the activities required to achieve these outputs. Finally, one needs to specify the inputs or resources required for these activities to be conducted. Each element of the ToC should be logical and based on evidence, which simplifies the communication of the ToC to stakeholders and helps maintain focus on the essential components.

By keeping the ToC straightforward and avoiding unnecessary complexity, it remains both understandable and actionable—the tool them becomes useful that not only in guiding strategy but also aiding in evaluating progress and adjusting approaches based on the actual results.

Utilizing a ToC to Screen and Optimize Impact

So how, then, can investors use this tool to screen and optimize impact?

A ToC as a tool for screening impact.

When assessing the impact feasibility & intentionality of a startup, an investor must answer at least three key questions:

- Is this company capable of delivering exponential impact?

- Is impact ingrained at the core of this organization?

- Do the founders clearly understand the problem and how their activities link to achieve deep, meaningful, and long-lasting impact that truly solves the root cause of the problem?

As you can see, these questions become easier to answer after seeing a ToC, and if every deal analyzed included a ToC the screening process would be much better informed. However, writing a good ToC without having an interaction with a startup is resource-intensive and requires specialized talent that can synthesize publicly available information into a concise, top-level ToC. Until now, applying this level of analysis to every company entering your deal flow was impractical and unprecedented.

As a tool to ensure maximizing impact

Once invested, the use of a ToC to analyze a company's ongoing impact involves a regular review to assess whether the intended outcomes and goals are being met as expected. It acts as a living document that informs impact measurement and management, allowing organizations to track their progress through the collection and analysis of data related to specified outputs and outcomes.

This ongoing analysis is crucial for identifying potential gaps or areas needing improvement in the strategy. Additionally, real-world experiences and feedback provide valuable insights that can be used to refine the ToC over time, enhancing the organization's ability to not only achieve but also effectively demonstrate its impact. In essence, a ToC is more than just a planning tool—it is a critical component of a strategy for achieving and optimizing measurable impact, making it an indispensable asset for impact investors looking to align their investments with their impact theses.

NorthStar's AI impact assessment

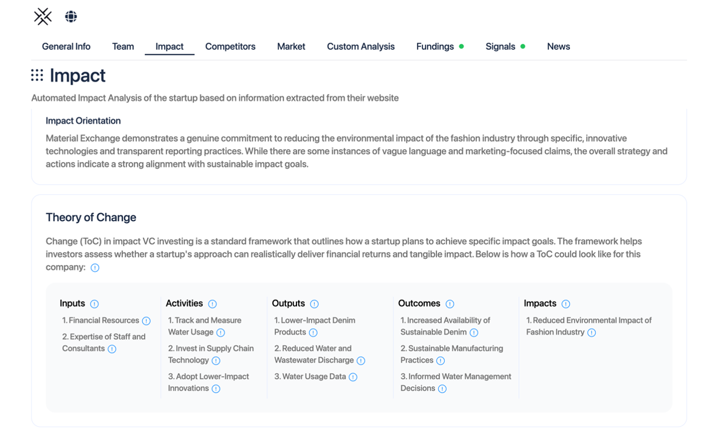

At Northstar, with support of our development partners, we developed an AI impact analysis tool that enables investors to have access to a distilled ToC before even deciding to engage with a deal. Every startup analyzed gets a complete impact assessment which includes, among other important impact frameworks a Theory of change.

Our impact assessment module enables you as an investor to quickly assess whether the deal meets your impact mandate, summarize the impact intentionality they communicate, identify gaps in their logic to achieve the impact, and ultimately conduct due diligence on their impact from the very first interactions with the founders. Disqualifying faster, and avoiding impact false-negatives, or false-positives.

More to come

Top level impact assessments are a great starting place for enabling impact investors to make well informed decisions. But what to do when founders (or investors) are not savvy in these frameworks or find it hard to write a compelling document to articulate their impact?.

With this challenge in mind, we did not stop at only an AI tool to assess impact, but we also developed a comprehensive suite of additional solutions for impact investors to tackle these challenges. Challenges such as guiding your founders and developing impact savviness, drafting and articulating impact, identifying and defining impact metrics (and using these to report impact to investors).

To learn more about our tools and suite of solutions, or simply to stay up-to-date sign up for our newsletter here. And if you are ready to become an investor that leverages on the power of AI to augment your operations, try our suite of AI tools to for impact investors. Click here!