Yes, and no.

At last year's Slush, we at Northstar hosted a roundtable on Investor Day with the topic of “AI for VC”.

Most of the participants agreed on the coming and inevitable dominance of augmented and AI-supported investment operations. New operational solutions covering all the core aspects of investing from sourcing, screening, and selecting, to portfolio-supporting and selling (exits). The 5 S’es crucial to get right for any investor, and in Northstar language the five key areas our platform aims to augment. AI-based tools are perfect for an overload of unstructured data and information domination, the true characteristic of early-stage startup investing, and Northstar is set to solve that.

Although most of the roundtable participants at Slush agreed on the general development, one topic sparked more disagreement.

This one topic that did spark the most engagement, was if it is possible to - in a reasonably near future - automate all aspects of venture investing. Or to “go full quant”, with references to the parallel development of Hedge Funds over the last 20 years, and since data scientists entered the trading rooms. For investing in the public markets this development shows no sign of stopping. Algorithmic trading now represents the majority (75%) of total trading. Will this history be repeated for venture capital? Yes, except that the maturity of AI models, data availability, and computational power will exponentially increase the speed.

At the same roundtable, there was a clear divide between the ages on this topic. A young data engineer from a large London-based VC argued heavily for the inevitable process of VC going full quant. With the introduction of AI and the availability of exponentially more data, this will happen sooner rather than later, was the core argument. He met the same resistance and counter arguments from the older investors around the table, as he said he got from the partners and managers back at his workplace. Arguments like, “VC investing is about getting access to deals, not only identifying them”, and “VC is about adding value as an investor”. Founders will not have bots at the cap table“. None of which convinced him.

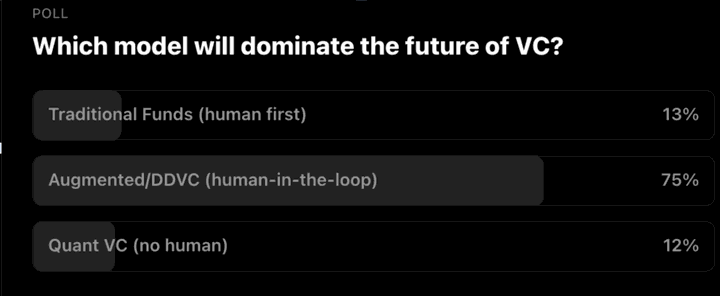

Only a few months later I learned about the first full Quant VC at the Data-driven Summit hosted in by Andre Retterath at Datadrivenvc.io., and the topic is well covered in this Data-driven VC article by the Quant VC Koble CEO Guy Convey. The Quant VC “Koble” was also introduced in this weeks Data-driven newsletter, and put into context with the surprising numbers of more than 10% of VCs in their survey believe “Quant VC” will dominate the future.

The simple conclusion related to this survey is that there is room for every aspect of investing from just applying productivity tools, to going all in quant, and for most VCs to go Augmented and combine both productivity enhancements, some quant and prediction metrics, as well as depending the human intelligence in the loop. VC is after all both art and science, and AI is still better at the science part...

This is also what we bet on at Northstar and why we first develop the productivity tools and analytical support you need to work lean as an investor. Then we aim to add prediction models, recommendations and quant where it is suited the most.

AI support tools will inevitably dominate operations, analysis, and decisions for impact investing characterized by massive amounts of unstructured data, a multitude of variables, and where no man really can compete with the algorithms, data processing, and computational power of machines.

Will it, then, impact investing go full quant anytime soon? Yes, as we already see the first Quant VC funds emerging, and no, as for the majority of investors a combination of augmented and quantified support tools will make operations leaner, at the same time they will benefit from keeping some human experts and solid relationships in the loop.

Stay in the loop

To learn more about our tools and suite of solutions, or simply to stay up-to-date sign up for our newsletter here. And if you are ready to become an investor that leverages on the power of AI to augment your operations, try our suite of AI tools to for impact investors. Click here!